Pakistan received a significant financial boost as the United Arab Emirates (UAE) disbursed a fresh loan of $1 billion to the country on Wednesday, July 12. This loan comes as the International Monetary Fund (IMF) projects a substantial rise in Pakistan’s external debt to $136.5 billion by the end of the fiscal year. The UAE’s contribution is a crucial milestone after the reopening of blocked financing pipelines.

UAE Deposits $1 Billion, Raising Total Exposure to $3 Billion

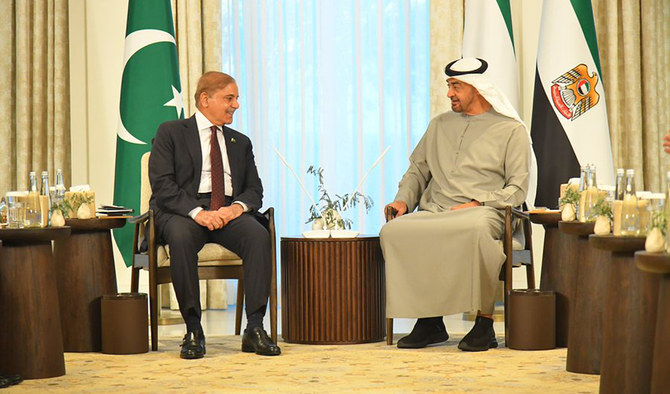

Finance Minister Ishaq Dar announced that the UAE has deposited $1 billion with the State Bank of Pakistan (SBP), increasing the UAE’s total exposure to $3 billion. This deposit places the UAE third in terms of cash deposits, trailing Saudi Arabia’s $5 billion and China’s $4 billion with the central bank. Minister Dar expressed gratitude to the UAE, highlighting the importance of this financial support for Pakistan.

Saudi Arabia Joins UAE in Depositing Funds after IMF Deal

In a positive turn of events, Saudi Arabia also deposited $2 billion with Pakistan’s central bank, following an agreement with the IMF. Both Saudi Arabia and the UAE had withheld bailout funds until Pakistan returned to the IMF. With the recent staff-level agreement between Pakistan and the IMF, disbursements from both countries have resumed, indicating renewed confidence in Pakistan’s economic reforms.

IMF Projections Highlight Pakistan’s Growing External Debt

The IMF has finalized its projections for Pakistan’s balance of payments in the medium term. Officials from the finance ministry report that Pakistan’s external debt stock is expected to increase from $123.6 billion at the end of the previous fiscal year to $136.5 billion by June 2024. This rise of $13 billion in debt stock primarily stems from the country’s high external debt repayment needs, financing of the current account deficit, and the requirement to increase foreign exchange reserves.

Pakistan’s economy received a much-needed boost as the UAE disbursed a $1 billion loan, increasing their total exposure to $3 billion. This development comes after Saudi Arabia also deposited $2 billion following an agreement with the IMF. However, as the IMF projects a significant increase in Pakistan’s external debt, the government must remain vigilant in implementing economic reforms and managing debt obligations to ensure sustainable growth.