President Ranil Wickremesinghe informed parliament that Sri Lanka had received the first installment of its bailout package from the International Monetary Fund (IMF).

Wickremesinghe stated on Wednesday that this “lays the foundation for Sri Lanka to have stronger economic discipline and enhanced governance”.

The $330 million first installment follows the IMF’s approval of a $3 billion rescue package for the island nation in distress on Monday.

In the third week of April, according to Wickremesinghe, government representatives will begin the next round of negotiations with bondholders and bilateral creditors.

This will open up prospects for low-interest loans, regain the trust of international investors, and build a solid new economy, he claimed.

The IMF rescue is anticipated to spur $3.75 billion in additional funding from lenders such as the World Bank, the Asian Development Bank, and others. That makes it possible for Sri Lanka to restructure a sizeable portion of its $84 billion in public debt.

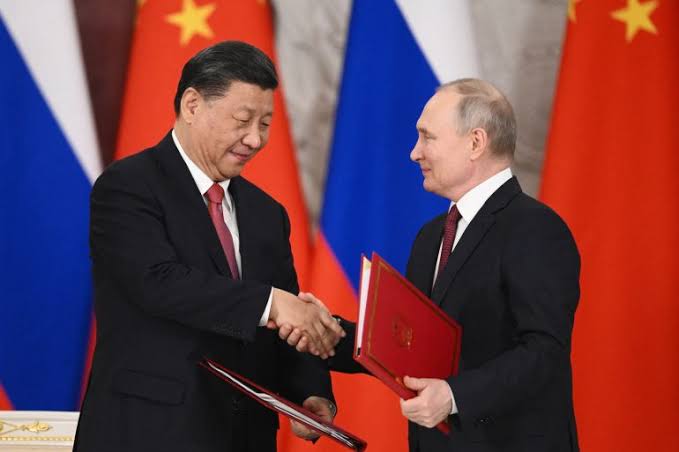

China, Sri Lanka’s largest bilateral creditor, agreed to restructure its loans to the country earlier this month, removing the last obstacle to the country receiving an IMF bailout.

According to Wickremesinghe, Sri Lanka also wants to lower inflation to a single digit by the middle of 2023 and thereafter to 4-6 percent. The nation’s National Consumer Price Index increased 53.6 percent on an annualised basis in February.

Shehan Semasinghe, the country’s state finance minister, stated in an interview that Sri Lanka is prepared to initiate negotiations with bilateral and private creditors about debt restructuring in order to regain financial sustainability as soon as possible.

This was Sri Lanka’s 17th IMF bailout and the third after the end of the nation’s protracted civil war in 2009.

The monies from the present programme, unlike earlier bailouts, which were primarily used to strengthen foreign exchange reserves, can also be used for government spending, senior IMF official Masahiro Nozaki said on Tuesday.

Beginning of last year, Sri Lanka faced a lack of dollars for imports of necessities due to economic mismanagement and the effects of the COVID-19 pandemic, sending the nation into its greatest financial crisis since independence.

Sri Lankans have had to deal with rising living expenses, hefty income taxes of up to 36 percent, and a 66 percent increase in power prices as a result of the crisis.