According to Prime Minister Datuk Seri Anwar Ibrahim, there is no need for Malaysia to continue relying on the US dollar to draw in investments.

He asserted that currencies from both nations should be used in negotiations between Malaysia and other nations.

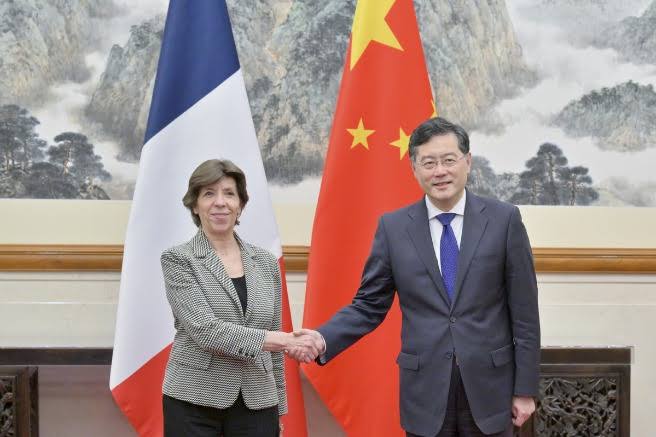

He claims that Bank Negara Malaysia has also proposed using the ringgit and renminbi to pioneer the said method in trade-related topics during visits to China.

The Asian Monetary Fund and the initial stage I proposed as the Finance Minister were of greater importance, as they were not well received in Asia at the time due to the US dollar’s strong position.

Ibrahim reportedly said that negotiations between Malaysia and other nations should take place using both national currencies, according to Astro Awani.

A plan to “pioneer the said way in a matter of trade during visits to China utilising ringgit and renminbi” is also being developed by Bank Negara Malaysia, according to what he said.

The instability of the economy now strongly defines how it is currently in the United States. Additionally, today’s jobs data shows that fragile character to its fullest.

On the other hand, the US dollar’s global aspects have taken centre stage, with Malaysia lately offering its viewpoint.

The Malaysian Prime Minister Datuk Seri Anwar Ibrahim said there is no justification for Malaysia to continue relying on the US currency.

Ibrahim adds that the growing reliance on American money is also a result of the current economic strength of countries like China, Japan, and others.

Ibrahim responded, “I think this proposal should be negotiated at least about the Asian Monetary Fund and can utilise the ringgit and the country’s currency accordingly,” he said.

“With the economic strength of China, Japan, and so on.” In particular, it was in response to questions about nations that no longer desire to conduct trade in US dollars.

The declining reliance on US dollars, led by China and Russia, has been a crucial part of news. Also intriguing is the viewpoint on how the US currency will affect future global trade while the nation is on the verge of national debt default.